If this is the case you will receive an error message when attempting to download the TXF file (i.e., “ Your import file contains IRS required information, the import of which is not supported by TurboTax”). Those transactions do not include IRS required codes which TurboTax does not support. TXF file provided for all IB account types?ġ, The account is question has qualifying transactions required to be reported on the Worksheet for Form 8949 andĢ. Yes, subject to the guidelines and considerations noted above. TXF file compatible with both the Windows and Mac operating systems?

#SAVE TURBOTAX RETURN AS .TXF SOFTWARE#

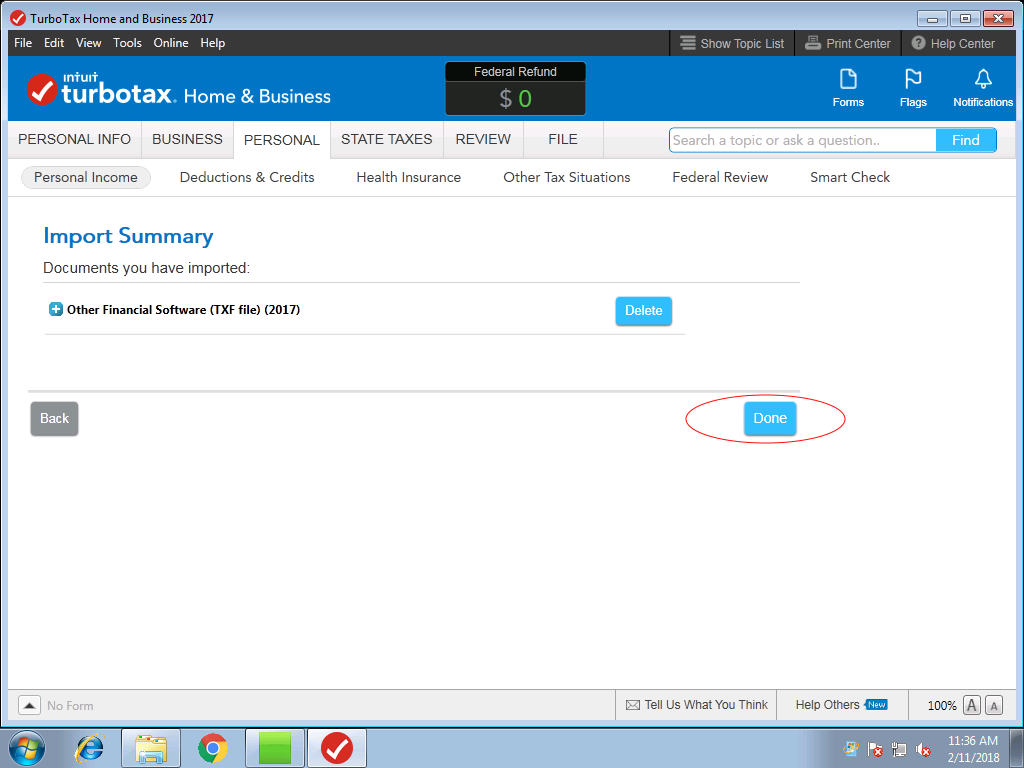

Note, however, that this is only a guideline and the actual functionality may vary depending the specific CD/download software package your are using (e.g., Basic, Deluxe, Premier, Home & Business, Business) and whether you are using a mobile or tablet version. As a general guideline, the CD/download versions support this feature and the online versions do not. While IB produces a file in a TurboTax Tax Exchange Format (.TXF), not all TurboTax applications accommodate this file import feature. detailed steps for completing this process may be found within KB2030.ĭo all versions of TurboTax support this file import feature? It also serves to reconcile balances reported on Form 1099-B and provides summary computations for Schedule D.įile import begins by logging into Account Management, selecting and downloading the file to your desktop and then importing from within TurboTax application. persons to report the sales of securities. The only tax report for which IB supports import to TurboTax is the Worksheet for Form 8949. Which IB tax reports may be imported into TurboTax?

0 kommentar(er)

0 kommentar(er)